Is it possible to set up your Robinhood account to lower your trading taxes? Whether you’re a newer investor or a seasoned pro, you will find that you cannot ignore taxes. As an investor, you must pay taxes on any gains you have for the year and any interest or dividends you’ve earned. With a short-term capital gains tax from 10 to 37 percent and a long-term capital gains tax from zero to 20 percent, it’s essential to identify ways to mitigate your tax liability.

When and how are your gains taxed?

Anytime you sell investments at a gain in your Robinhood account, you will pay taxes.

For example, let’s assume you bought ten shares of Gamestop in November of 2020, right before the r/wallstreet bets frenzy. Your shares would’ve cost around $11 each, for a total cost of $110 (10 shares at $11 per share).

Then, let’s assume you held on to the shares as they climbed, selling near the top at $300 per share in January of 2021. When you sold your ten shares at $300 each, you would have received proceeds of $3,000 (10 shares x $300/ea).

To figure out your taxable gain, take your proceeds of $3,000 minus your original cost basis of $110 for a total taxable gain of $2,890. Now, they're taxed at short-term rates because you held the shares for one year or less.

Instead of getting the favorable long-term capital gains rates, the gain of $2,890 is taxed just like ordinary income, at your highest marginal tax rate. Assuming you’re in the 24% tax bracket, you would have a tax bill of roughly $694 for your Gamestop transaction ($2,890 gain x .24).

The entire transaction is then reported on your tax return for the year 2021, using Schedule D to calculate your total gain or loss and the accompanying tax bill.

What are the short-term and long-term rates?

If you hold an investment for one year or less, it is considered ashort-term gain or loss. If you hold an investment for more than one year, it is considered a long-term gain or loss. Short-term gains are taxed at ordinary-income rates, while long-term gains receive more favorable tax treatment.

Tax Rates for Long-Term Capital Gains 2022

Tax Rates for Short-Term Capital Gains 2022

Are there other account types with better tax advantages?

Unfortunately, Robinhood only offers taxable brokerage accounts at this time, though they’ve expressed interest in adding more account types in the future.

That means anytime you sell investments in your Robinhood account, you’re creating a taxable event. If it’s a gain, you will pay taxes on it, and if it’s a loss, you can use it to offset gains and then take a deduction for an additional amount.

Although Robinhood doesn’t offer them, there are other types of tax-advantaged accounts. For example, retirement accounts such as IRAs, Roth IRAs, and 401(k)s all have tax benefits that shelter any trades made within the account from taxes.

So, using the same example above, if you had bought and sold Gamestop stock within your IRA or Roth IRA, there would be no taxes to report, as long as you didn’t withdraw the money from your account. This is a special advantage retirement accounts have known as “tax-free growth.” This means that any of the trades within the account, any dividends earned, and any interest earned is not taxed along the way. You only pay taxes when you withdraw the money for Traditional accounts or put the money in originally for Roth accounts.

While you are only eligible to contribute to a tax-advantaged 401(k) if your employer offers one, anyone can open a Traditional or Roth IRA, assuming they meet the IRS requirements. Contributions are also limited to an annual amount set by the IRS.

If you’re interested in a tax-advantaged retirement account, many brokerages like Fidelity, M1 Finance, Charles Schwab, and Vanguard offer investors Traditional and Roth IRA accounts, so be sure to choose one that works for you.

Can you deduct investment losses?

Yes, you can deduct investment losses up to a certain amount.

The current tax law allows you to use investment losses to offset your investment gains. Then, if you have additional losses left over, you can take another $3,000 loss per year to offset other income on your tax return. Any additional losses above the $3,000 are then carried forward to future years.

However, if you meet certain qualifications for tax trader status, you may be eligible to deduct all of your losses without limit.

What is tax trader status?

What is tax Tax trader status, also known as “traders in securities” by the IRS, is a special status allowed for certain day traders. This tax status allows traders to deduct their investment losses in full each year, rather than limiting them to $3,000 over their gains.

To qualify for this status, traders must meet precise guidelines and tests by the IRS, which will allow them to make a valid mark-to-market election under section 457(f) of the tax code. This means that traders are no longer subject to the loss limitations or the wash sale rule, allowing them to receive more favorable tax treatment.

That said, tax trader status is not for the typical investor and will require the help of a tax pro to make sure all qualifications, tests, and elections are made correctly.

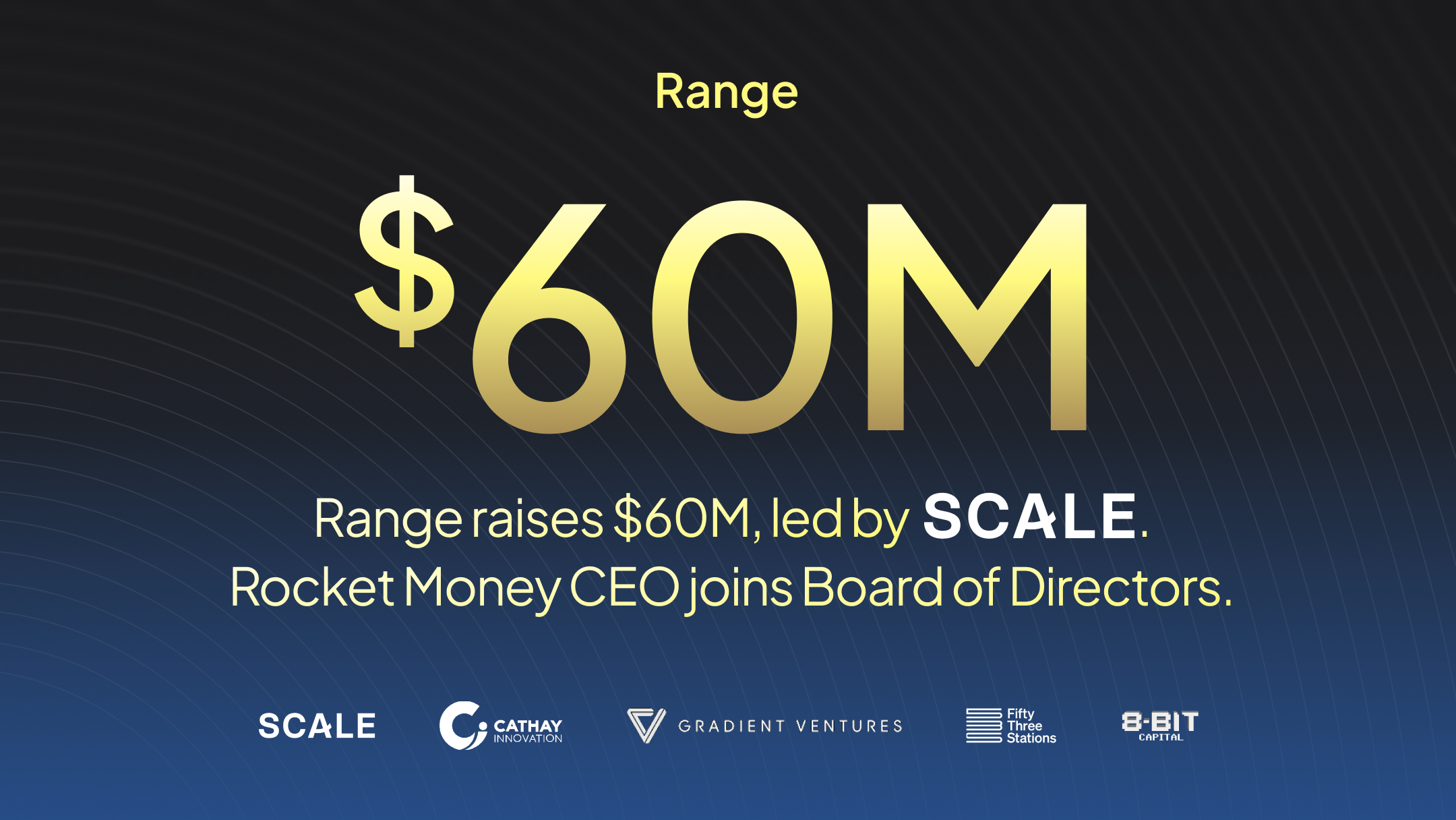

Range is here to help.

With Range, you can connect all your finances into a single dashboard to track, monitor and plan the best version of your life. Say goodbye to middlemen and spreadsheets and hello to the new financial you.

.svg)

.svg)

.svg)