The primary difference between ISOs and NSOs lies in their tax treatment. Learn how to get the most out of your stock options.

You've received stock options from your employer – congratulations! This valuable form of compensation can significantly build your wealth, but the tax implications can be complex. Many professionals feel overwhelmed by tax decisions related to their equity compensation, especially when trying to understand the differences between Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs).

Understanding Stock Options

Stock options aren't actual shares of stock—they're the right to purchase a set number of company shares at a fixed price, commonly called the strike price or exercise price. Your purchase price stays the same over time, so if the company's value increases, you could make money on the difference.

Two Types of Stock Options

The two main types of stock options offered are:

- ISOs (Incentive Stock Options): Offering favorable tax benefits under specific conditions.

- NSOs (Non-Qualified Stock Options): More flexible but with less favorable tax treatment.

How Stock Options are Taxed: ISO vs NSO

The primary difference between ISOs and NSOs lies in their tax treatment.

ISOs can offer strong tax advantages. If you hold ISOs long enough and manage them strategically, you can unlock the possibility of only paying long-term capital gains tax (up to 20%) on all appreciation from your strike price to your sale price, instead of having some (or all) of those earnings taxed at ordinary income tax rates, which can go up to 37%.

Here’s how these two types of equity are taxed at different moments:

NSO Tax Treatment: What You Need to Know

NSOs lack the tax advantages of ISOs, making them less favorable from a tax perspective. However, there are still strategies that can lower the taxes you’ll owe on them.

NSOs typically trigger taxes at two points:

- At Exercise: When you purchase NSO shares, the "spread" (difference between your strike price and the current fair market value) is taxed as ordinary income. Your company will typically withhold these taxes when you exercise your NSOs.

- At Sale: When you sell NSO shares, any additional appreciation is taxed as capital gains, just like with regular stocks. The rate depends on how long you held the shares after exercise:

- Less than one year: Short-term capital gains (ordinary income rates)

- More than one year: Long-term capital gains (preferential lower rates)

ISO Tax Treatment: Potential Tax Advantages

ISOs can offer employees significant tax advantages when handled correctly. However, they come with strict eligibility rules and conditions for maintaining their tax advantages.

- At Exercise: Unlike NSOs, exercising ISOs doesn't trigger ordinary income tax. (Although, the spread may be included in Alternative Minimum Tax (AMT) calculations, which could result in additional tax liability.)

- At Sale: Here's where you get the opportunity to harness the ISO tax advantage. If you meet specific holding requirements (known as a "qualifying disposition"), you may be eligible for preferential long-term capital gains treatment on the entire gain (from original exercise price to final sale price).

To qualify, you must hold the shares for:- At least two years from the grant date, AND

- At least one year after exercising

Strategic Tax Planning for Your Stock Options

Creating a thoughtful exercise and selling strategy can significantly reduce your tax burden. Consider these approaches:

- Exercise timing: Strategically timing your exercises can help minimize AMT impact for ISOs.

- Holding periods: Planning sales to qualify for long-term capital gains rates can seriously pay off.

- Tax-loss harvesting: Offsetting gains with strategic investment losses.

- Cash flow planning: It’s important to ensure you have liquidity to cover tax obligations that come with exercising and selling stock options.

Why Understanding Stock Option Taxation Matters

Many professionals receive substantial equity grants and remain uncertain about the best approach to maximize after-tax value.

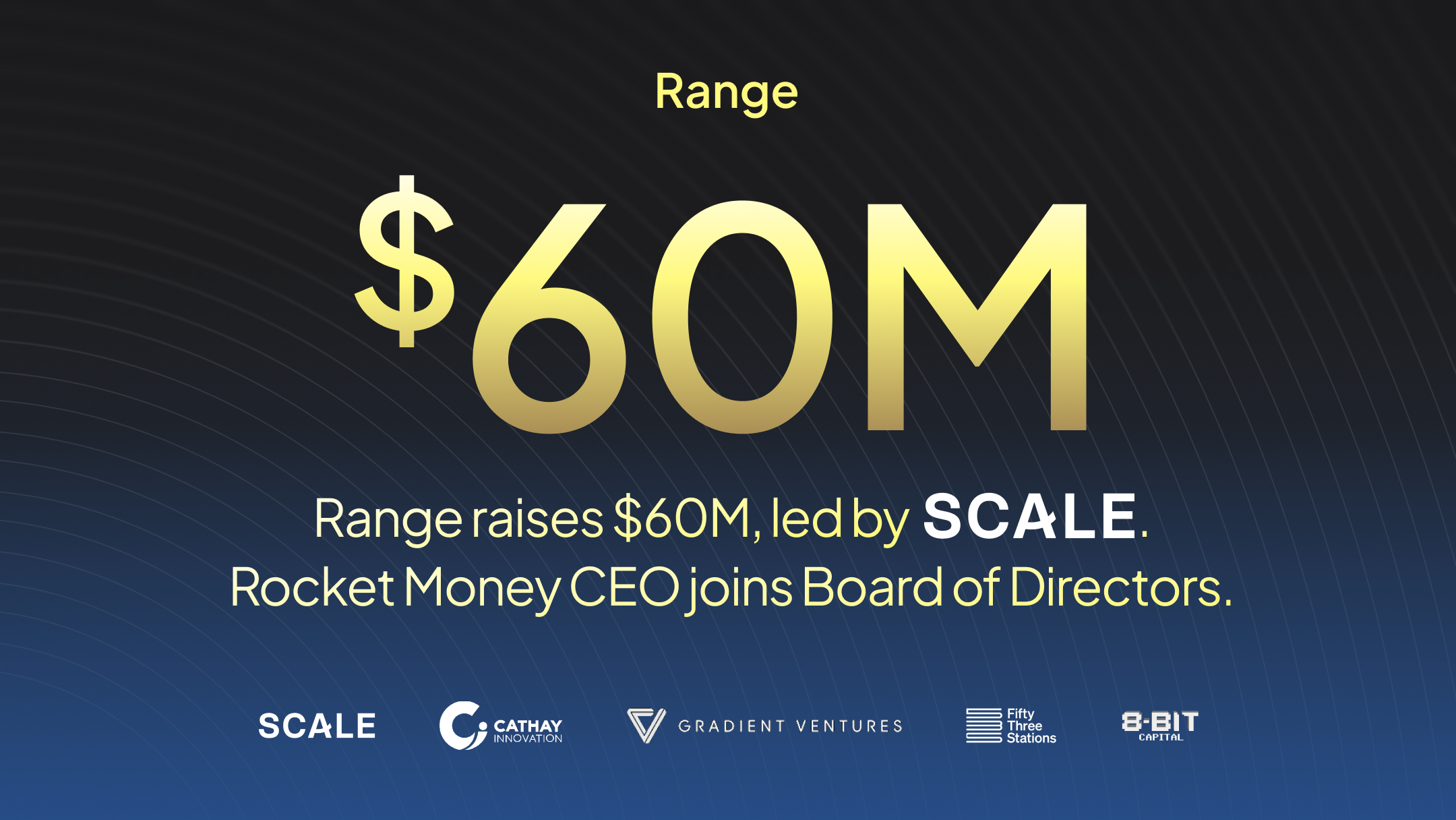

Range’s all-in-one wealth management approach specializes in helping clients with equity compensation maximize their gains and make informed decisions by:

- Creating customized exercise strategies that consider their broader financial picture

- Planning to minimize surprise tax bills

- Integrating stock options into a comprehensive financial plan

- Merging tax and portfolio management into a single service, ensuring alignment between portfolio and tax strategies.

At Range, we specialize in helping high-income households and professionals like you make smarter decisions with your equity compensation. Whether it’s strategizing for tax efficiency or creating a comprehensive financial plan, our team is here to guide you every step of the way.

.svg)

.svg)

.svg)