TL;DR

The home-buying journey begins with the decision to buy a house and (hopefully) ends with the keys to your new home and a bottle of champagne on the kitchen counter. Frankly, it can be a lot to handle between getting your finances in order and navigating the several steps. Having a good team behind you makes all the difference. This post is intended to walk you through the process of buying your dream home from start to finish.

THE ROAD TO HOME OWNERSHIP

If you're looking for other helpful insights into buying your home, take a peek at Part I (Rent vs. Buy) and Part II (Affordability) before digging in here!

1. Get your finances in order and determine a realistic purchase price range

The first step in buying a home is getting your finances in order and determining a realistic purchase price range. It's important to know what size mortgage you're able to take on, as well as how much of a down payment you'll need in order to be competitive with other buyers looking at similar properties. This will help you remain realistic about what kinds of homes are within your reach so that you don't waste time looking at properties that are too expensive for your budget or credit situation.

You also need to know what kind of monthly mortgage payment you can afford. Once you know this, you can determine a realistic purchase price range based on your income, savings, and credit worthiness. If you're not there yet in your journey, go back and check out Part II of our Home Buying series!

2. Make a plan for saving and protecting your down payment funds

Most potential homebuyers use cash flow and existing investments to save for their down payment, using monthly income to bolster existing balances and achieve their future goal.

First, you can start by setting up a couple of automatic transfers into your bank account each month. If you need help with your budget, definitely go back and check out our blog post on budgeting and the 50/30/20 rule. The goal is to grow this portfolio until it covers a 5-20% down payment on a property (the next step).

It can be tempting to use any money you get your hands on for the purposes of home buying—but if you start piling up credit card debt or draining your emergency fund or even increasing your income and not putting that extra cash toward home buying, something has gone wrong with your plan. It's important to know what percentage of your income that you're saving every year.

Using all available funds, we recommend keeping your down payment in very safe parking spot such as checking, money market, or high yield savings. If your home purchase is likely not going to occur for 1-2+ years, you can consider investing those dollars in riskier investments such as intermediate-term bonds or even stocks. Be careful, as the stock market is very unpredictable, and you don't want your down payment fund to go down significantly at the worst time!

3. Get preapproved for a mortgage

Pre-qualification is the first step in the home buying process, and it’s important to understand what it means. This a process used by lenders to determine how much money you can afford to spend on your next home by conducting an analysis of your finances. These online forms typically request all of your assets and liabilities, such as credit card debt, car payments, and student loans. Recently, mortgage lenders have been collecting this data using online portals and data collection tools. After clarifying your data and talking to you about your desire to purchase a property, the lender will then tell you how much of a mortgage they feel comfortable lending based on this information.

Your credit score, income, assets, employment history, and residential history all play a vital role in determining your loan worthiness in the eyes of home lending financial institutions.

Do you have questions about credit best practices? We've got a credit blog for that.

4. Engage with a trusted real estate agent

Finding a talented, knowledgable, and trusted real estate agent is crucial.

Real estate agents can tell you about different neighborhoods, schools, and other information that can help narrow down your search—and they might even be able to save you some time while you keep working!

The home buying process can be stressful enough without having to worry about every detail. A good real estate agent is like a personal assistant who takes care of everything for you.

Here's how a good real estate agent can help:

- They can guide you through financing options, paperwork, and other traditional etiquette in the home buying process.

- They can help you find the right house at the right price.

- They can negotiate with the seller on your behalf.

- They can guide you through appraisal and inspections, while making sure you stay well-informed with everything before closing day.

5. Begin the shopping process and find your ideal home

Once you decide to buy a home, have your finances in order, have engaged with a trusted real estate agent, and have been pre-qualified - now you must start the house-hunting process!

Location, location, location: Where is the house located? Is it close to your office or school? Are there amenities like grocery stores, restaurants, and other conveniences nearby? How far are you from mass transit? Are there good places for kids to play nearby? See how this neighborhood treats its current residents.

Walk around the area and take note of how much activity there is. If it seems unsafe or unwelcoming, keep looking!

Space: How many bedrooms do you want? Do you want a den, an office or an extra bedroom for guests? What about a yard? Be sure to consider that smaller homes don't have room for storage space; if you have more stuff than will fit in the home, consider building an addition or renting a storage unit.

Once you know how much you can spend on a home and what kind of neighborhood you want to live in, start looking at available homes for sale in your price range—and keep your eyes peeled for those with good deals! Remember that buying a home is a two-step process: one part is finding the perfect home; the other is negotiating the price of that home and getting your offer accepted.

6. Make an offer (or many)

When you put in an offer on a home, you've got to be ready for offers from other buyers. If there are multiple bidders, the seller will draw up the offers and pick a winner. It can be difficult to get an offer accepted in competitive markets, but if you're not prepared for it, it might be almost impossible. Don't get discouraged! If you have done the work up front and teamed up with trusted partners, you should be well on your way to home ownership.

7. Move forward with mortgage underwriting

You know the property you want to buy and how much you'll have to pay for it. Now you'll choose a lender to get a mortgage from (you can go with a lender that preapproved you, or start fresh with a different one). Even with an online-first lender, you'll often work closely with a loan officer to complete the actual application.

Once your mortgage application is complete, you'll go into underwriting. During this process, the lender makes a final decision on whether to give you the loan — it's basically making sure there's not anything about the deal that's just too risky.

This is a paperwork-heavy process, so get ready to do a lot of document hunting and uploading. Here's what you're likely to need:

- W-2 and/or 1099 forms from the past two years (possibly more, if you've changed employers).

- Pay stubs from the past 30 to 60 days.

- Proof of other sources of income (including documentation of any gift money).

- Federal income tax returns from the past two years.

- Recent bank statements (usually for the last couple of months).

- Details on long-term debts like car or student loans.

- Photo ID and Social Security number.

Underwriting includes digging deep into your finances, so you may need to come up with even more documents. They will also often ask for more recent statements showing the funds for the down payment - even all the way up until closing day.

8. Obtain homeowners insurance

Insurance is a great way to protect your investment, and there are many types of homeowners insurance that can help you recover from unexpected events.

It's a good idea to start shopping for homeowners insurance as soon as you sign a contract to buy a home. This allows you to shop around for quotes and gives you time to get your policy in place before closing on the purchase. Typically, you will have a month or more between the time you sign a contract and the day you close on your new home. Do you need to have homeowners insurance before closing? Yes, you'll typically need to prove at closing that you've paid the first full year of premiums on your homeowners insurance.

9. Schedule a home inspection of the property

A home inspection is performed by an independent inspector. This person will not be involved in the sale of your home and has no vested interest in whether you buy or not. Their job is to conduct a thorough inspection and produce a comprehensive report for you regarding the property's condition.

The inspection process begins with the inspector visiting your potential new home, taking note of any obvious problems or issues that need attention. They'll examine both interior and exterior areas of the house from roofing materials to plumbing systems and electrical wiring. Based on their findings they'll create an estimate of costs required for repairs or maintenance before moving on to more detailed inspections such as structural elements like walls, floors, ceilings, heating systems, water supply lines, appliances, electrical outlets, indoor air quality tests, etc.

Here's a good summary of an inspection checklist from NerdWallet.

It's important to remember that no matter how nice a house looks when touring it during showings there may be problems lurking beneath its surface that could affect its long-term worthiness as well as its safety level - especially if any major renovations would be necessary after purchasing one!

10. Schedule a home appraisal of the property

The home appraisal process is a very important step leading up to closing on your dream home. The appraisal is an estimate of how much the property is worth, and it's required to ensure that your loan does not exceed the value of the property. You'll also need one if you plan on taking out a home equity loan; those are pretty common these days, and they're often used for renovations, building additions, or refinancing your existing mortgage.

In most jurisdictions, the appraiser you choose will be picked by the lender and will cost you nothing. If you want to use your own appraiser, however, that's fine too; even though many lenders try to discourage it in order to streamline their process, they can't stop you from doing it. But why would anyone want to use their own appraiser? It may not be worth the trouble if you're only planning on buying one house or if there's no other reason for choosing your own appraiser other than your sheer personal preference—but if you're buying an older home in an area where property values have been dropping and/or you've bought a fixer-upper that may need more work done than the average house, then using your own appraiser could save you from losing thousands of dollars due to a lower appraisal value.

11. Close on your new home and get the keys!

The official closing typically takes place at the office of a lawyer, real estate agent, or other third party that handles closings. You'll sit down with the seller, agent, and/or lender to sign paperwork to legally transfer ownership of the home to you. This is called closing on the home. This process typically begins with a walk-through of the house by you, the buyer(s), and the seller. At this point, there are usually no major complications and most of your questions have been addressed by your agent or by asking your own questions of the seller.

The next step is for all parties to sign off on all the paperwork for closing—the most important document is called a HUD-1 statement. Usually, this is done at a title company or lawyer's office but in some cases it may be done at your own bank.

The HUD-1 statement lists all charges associated with the transaction, including down payment, inspection fees, origination points, loan fees, and even points to remember when moving in.

NEXT STEPS

Knowing the process before you begin home buying is important to ensure that you’re prepared for what comes next. Home-buying can be an exciting time, but it also requires a lot of planning and preparation! To recap, we walked through 3 main components of home ownership:

- Part I - Rent vs Buy

- Part II - Affordability

- Part III - Process

We hope this series has been informative for you and that you feel prepared to buy a home. The process can seem daunting at first, but if you take things step-by-step and make sure everything is in order before doing so, it will be much easier on you and your family!

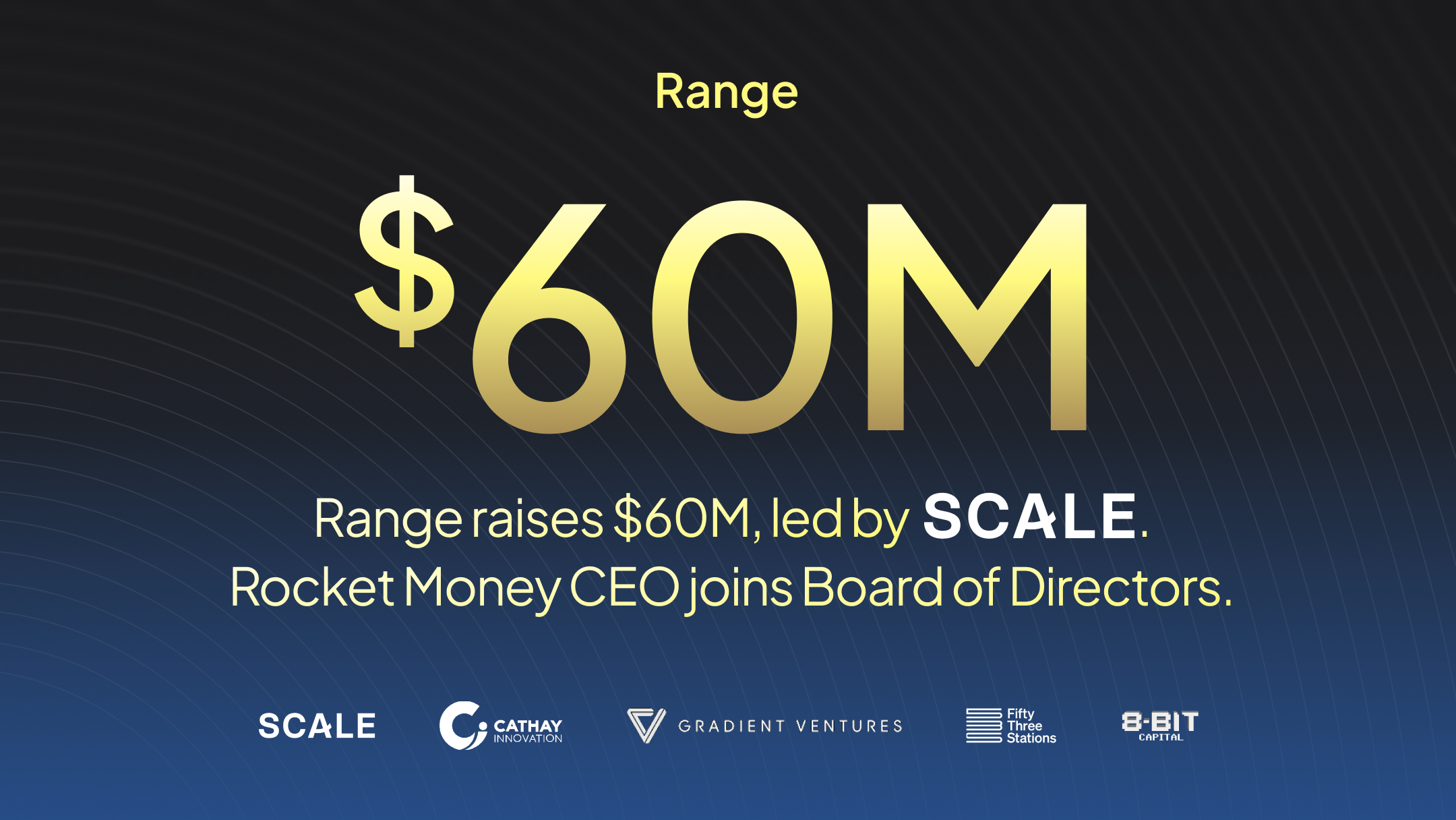

Range is here to help.

With Range, you can connect all your finances into a single dashboard to track, monitor and plan the best version of your life. Say goodbye to middlemen and spreadsheets and hello to the new financial you.

.svg)

.svg)

.svg)