Key Takeaways:

- SALT deduction quadruples to $40,000 for earners under $500,000

- Estate tax exemption jumps permanently to $15 million per person ($30 million for MFJ)

- QSBS benefits expand dramatically with graduated exclusions starting at just 3 years

- 37% top marginal tax rate becomes permanent preventing scheduled increase to 39.6%

- 20% capital gains rate preserved permanently avoiding planned jump to 25%

The "One Big Beautiful Bill Act" fundamentally reshapes the tax landscape for high-income earners. The estate tax exemption jumps to $15 million per person, SALT deductions quadruple to $40,000 (with income limits), and QSBS benefits expand with graduated exclusions starting at just 3 years.

These changes represent major potential tax savings—but only if you take advantage of all the new tax regulations that may apply to you.

How the GOP Budget Law Will Impact Your Taxes

Here are the main changes in Trump’s “Big Beautiful Bill” impacting high-income earners:

1. SALT Deduction: Temporary $40k Limit with Income Phaseouts

What is the SALT Deduction?

The State and Local Tax (SALT) deduction allows taxpayers to deduct state and local income taxes, property taxes, and sales taxes from their federal taxable income. This deduction is particularly valuable for residents of high-tax states like California, New York, and New Jersey, where state income and property taxes can be substantial.

What changed?

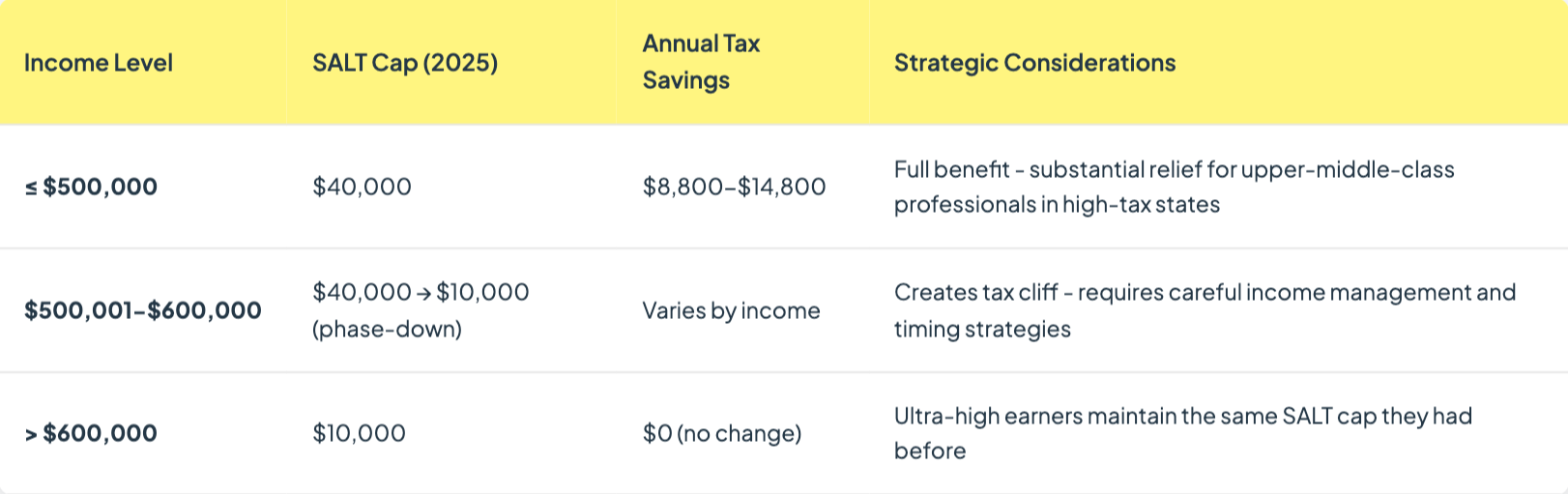

The state and local tax (SALT) deduction cap increases from $10,000 to $40,000 per household for 2025, but this change comes with income level restrictions:

How the New SALT Limits Work

Real-World Impact

A married couple in California earning $450,000 with $25,000 in state income taxes and $15,000 in state property taxes can now deduct $40,000 instead of $10,000. Assuming a 35% federal rate, this could translate to $10,500 in annual savings, compared to what this household could’ve deducted with the previous SALT Cap. Over a decade, that's $105,000.

Timing Matters: The cap is set to increase by 1% annually through 2029, then reverts to $10,000 in 2030 unless new legislation is passed.

2. Estate Tax: Permanent $30 Million Household Exemption

What is the Estate Tax?

The federal estate tax is a tax on the transfer of wealth when someone dies. It applies to estates valued above a certain threshold (the exemption amount). For 2025, estates worth more than $13.99 million (single) or $27.98 million (married couples) are subject to a 40% tax rate on the excess amount.

What changed?

The estate tax exemption permanently increases to $15 million per person ($30 million for married couples) starting in 2026. This isn't just a number change—it's a fundamental shift in generational wealth planning that affects far more families than the current exemption suggests.

Without this bill, the exemption would have dropped to approximately $7 million per person in 2026, $14 million for a couple filing jointly.

Estate Tax Exemption Changes

Real World Example

A married couple with $25 million in assets would pay $0 in estate taxes under the new law versus potentially $4.4 million if exemptions had dropped to $14 million for a couple filing jointly.

3. Top Federal Income Tax Rate Will Remain at 37%

What is the Top Marginal Tax Rate?

The top marginal tax rate is the highest percentage of federal income tax applied to your last dollar of earned income. For 2025, single filers earning over $626,350 and married couples earning over $751,600 pay 37% on income above those thresholds. This rate was set to expire and revert to 39.6% in 2026 if no new legislation was adopted.

What changed?

The top marginal income tax rate of 37% becomes permanent for high earners, preventing the scheduled increase to 39.6% in 2026. This affects single filers above $626,350 and married couples above $751,600 in 2025.

Impact of the Top Marginal Tax Rate Update

A high earner with $1 million in ordinary income could potentially save close to $10,000 in annual taxes against their potential tax liability if the 39.6% rate had taken effect as planned.

Beyond the cash savings that come from paying income taxes at a lower rate, this change is helpful to those trying to optimize their tax efficiency because it offers more certainty. High earners can now structure compensation, retirement distributions, and business decisions around a known tax environment rather than planning for rate increases.

4. QSBS: The Startup Equity Game-Changer

What is QSBS?

Qualified Small Business Stock (QSBS) is a special tax benefit for investments in eligible small businesses. Under Section 1202 of the tax code, investors can exclude up to $10 million in capital gains from federal taxes if they hold qualifying stock for at least five years (this remains the benefit for any stock acquired before the new tax law was enacted). The company must be a C-corporation with gross assets under $50 million when the stock is issued, and it must conduct an active business (not passive investments).

What changed?

QSBS stock purchased after the new law was enacted can access a tax exclusion of 50% 3 years after its purchase or 75% 4 years after its purchase. The original 5-year holding minimum to access the full deduction remains in place.

Additionally, the maximum tax exclusion increased from $10 million to $15 million (or 10 times your original investment, whichever is greater), while the company’s maximum gross asset threshold rose from $50 million to $75 million, meaning more mature startups remain QSBS-eligible for longer.

Implementation Note: The new QSBS rules apply only to stock acquired after enactment, making timing crucial for current equity holders considering exercise decisions.

New QSBS Holding Period Benefits

QSBS Tax Savings Example

You exercise $100,000 in startup options that grow to $5 million over 4 years before acquisition:

- Old Rules: $1.37 million in taxes (no exclusion before 5 years)

- New Rules: $343,000 in taxes (75% exclusion after 4 years)

- Tax Savings: Over $1 million

This isn't theoretical—it's the new reality for startup employees and founders.

5. Capital Gains Rate: Preserving Investment-Friendly Taxation

What are Capital Gains Rates?

Capital gains tax applies to profits from selling investments like ETFs, mutual funds, stocks, bonds, or real estate held for more than one year. The rates are 0%, 15%, or 20% depending on your income level, which is generally lower than ordinary income tax rates. For 2025, the 20% rate applies to single filers above $533,401 and married couples above $600,051. High earners also pay an additional 3.8% Net Investment Income Tax (NIIT).

What changed?

The new legislation maintains the 20% top long-term capital gains rate permanently, preventing a scheduled increase to 25% in 2026. This preservation of investment-friendly taxation is crucial for high-earners who generate significant capital gains from stock sales, real estate transactions, and business exits.

What Would Have Happened

Without the bill, the top capital gains rate would have jumped to 25% for high-earners in 2026, and the income thresholds would have been tied to ordinary income brackets, meaning more taxpayers would have hit the top rate at lower income levels.

Impact of the Capital Gains Rate Update

Real-World Example

On a $1 million capital gain, the difference between the 20% and 25% rates is $50,000 in additional taxes. For high earners with substantial investment portfolios or business exits, this preservation of the lower rate could represent significant savings.

Other Important Updates: 100% Bonus Depreciation

What Is Bonus Depreciation?

Bonus depreciation allows businesses and real estate investors to deduct a percentage of qualifying asset costs immediately in the year of purchase, rather than spreading the deduction over multiple years through regular depreciation schedules. This accelerates tax savings and improves cash flow for business owners and property investors.

Qualifying assets include machinery, equipment, technology, furniture, and certain property improvements with recovery periods of 20 years or less.

What Changed?

The "One Big Beautiful Bill Act" permanently restored 100% bonus depreciation for qualified property acquired and placed in service after January 19, 2025. This reverses the previous phase-out schedule that had reduced bonus depreciation to 40% in 2025 and would have eliminated it entirely by 2027.

Thanks to this update, business owners and real estate investors can now deduct the full cost of eligible business assets the year they purchase them, rather than spreading the depreciation over several years. This can unlock thousands in additional first-year deductions while improving cash flow.

How Range Turns Tax Changes Into Wealth Opportunities

Understanding these tax changes is just the beginning. The real value comes from implementing sophisticated strategies that coordinate these benefits with your complete financial picture.

Range's comprehensive approach includes:

- Tax Strategy Optimization: Coordinate SALT deductions, QSBS benefits, and charitable giving for maximum savings

- Estate Planning Updates: Restructure trusts and wills to leverage the new $15 million exemption

- Equity Compensation: Optimize startup stock option exercises under expanded QSBS rules

- Year-Round Planning: Proactive strategies that adapt to changing tax laws and opportunities

Curious to see what tax-saving opportunities you may be missing? Book a free demo to learn more about how Range could optimize your wealth strategy.

The Implementation Reality

These changes are now law, but that doesn’t mean you are well-positioned to fully take advantage of them. Range's team of CFPs and tax experts can help you navigate the new regulations and implement strategies tailored to your specific situation. The tax planning decisions you make in the next 90 days could determine how much you benefit from these historic changes.

The "Big Beautiful Bill" represents the most significant tax reform for high earners in recent years. The opportunities are substantial, but they require sophisticated planning that goes beyond basic tax preparation. For high-income professionals, the difference between understanding these changes and implementing them strategically could mean hundreds of thousands in tax savings—or missed opportunities that can't be recovered.

The information provided is current as of 07/07/2025, is subject to change, and is not meant to be relied on as tax advice or a recommendation. Please consult https://www.irs.gov/ for up-to-date information.

Tax services by Range Tax, LLC. Investment advisory services by Range Advisory, LLC an SEC-registered investment adviser. Registration with the SEC does not imply any level of skill or training. Affiliated but separate entities. For more information about Range Advisory’s services, fees, and disclosures, please visit range.com.

.svg)

.svg)

.svg)