TL;DR

It’s important to review your offer letters and option grants carefully before making big decisions like accepting a startup gig, exercising options, or selling your shares for cash.

- Options are granted when you start. Key factors are # of options, grant price, strike price, fair market value, vesting schedule, and type of equity.

- ISO’s are most commonly awarded to startup employees. These can be tricky, as the “bargain element” (market value - strike price) can trigger a big AMT (alternative minimum tax) amount due when you file your tax return for the year in which you exercise.

- Vesting, holding period, tax treatment, and exercise price all have a big impact on how much “net” cash you’ll ultimately receive from your equity.

STARTUP EQUITY

The 3 main types of equity are:

- ISO - Incentive Stock Option

- RSU - Restricted Stock Unit

- NQSO - Non-Qualified Stock Option

This post focuses specifically on ISO’s, which is the most common stock type awarded to startup employees. Exercising ISOs can trigger AMT (Alternative Minimum Tax), which may cause you to pay more in taxes than under your regular income tax calculation.

Make sense? It’s not intuitive, but we can help. AMT can result in big tax payments due when you exercise, even though you haven’t received any cash from selling the shares at play. This is known as “phantom” income. Spooky…

Here’s a timeline of how ISO’s work and the main events at each phase:

Equity can be a massive reason to join a startup early, but knowing things like how or when to exercise, how to sell your options for cash, how much you’ll profit, and how much you’ll pay in taxes is challenging at best.

A stock option is a contract that gives you the right (not obligation) to buy a stock at an agreed-upon price and date.

Most startups give out Incentive Stock Options (ISOs). These options become valuable when the fair market value is above your strike price. But how do I know the fair market value of my early-stage startup? When should I exercise? What will my tax bill look like?

The variables are many, and there’s no “one size fits all” scenario…

KEY DEFINITIONS

# of Options

The number of shares you possess the right to purchase, which are typically earned over time with vesting.

% Ownership

Your percentage ownership of the company’s total outstanding equity, assuming that you exercise all of your options. This is calculated as:

(number of options ~divided by~ total outstanding shares issued by the company).

Dilution

Most startups have to raise multiple rounds of funding before they reach a liquidity event. During these rounds, company founders have to hand over a percentage of the company to their new investors. This requires issuing new shares, which often results in dilution of existing owners of equity (less overall % ownership than before).

Exercise (Strike) Price

The per-share price that you pay to exercise (purchase) your options.

Vesting

This is a big one. Typically your equity grant will be subject to vesting, which just means that even though you may have been granted (awarded) shares initially, you need to earn the shares over time by staying with the company for a certain period of time.

The most common vesting schedule is 4 years, with a 1-year “cliff”. If you stay at the company for 1 year, 1/4th (or 25%) of your shares will vest on that day. After that, typically 1/48th (or 2.08%) of your shares will vest every subsequent month. This means that if you leave the company before your first year, unfortunately you will walk away with nothing. If you walk away after 1.5 years, you’ll have vested ~33% of your options (16 months / 48 total).

My financial goals require cash. When will I be able to convert my options into cash?

Great question. Typically, options can’t be “cashed in” until your company has a liquidity event of some kind. The following are the most common ways you’ll be able to exchange your equity for cash:

Initial Public Offering (IPO): The best-case scenario is usually an IPO (Initial Public Offering) when your company files to go public (listed on a public stock exchange, gets a ticker symbol, etc). When this happens, you can exercise your options and sell the stock on the public market (hopefully at a big increase).

Acquisition: If your startup gets acquired your options may be converted into cash, converted into options in the purchasing company, or perhaps be worth nothing. It all depends on the terms of the acquisition deal.

Internal / Secondary Markets: If your startup hasn’t yet reached a liquidity event, you may also be able to sell your shares internally within the company (if allowed), or on a secondary market for startup equity.

When should I exercise my options?

Perhaps the most important question of all. Exercising your options can be very expensive, so deciding when to exercise depends heavily on your specific financial situation and the specifics of your equity. It’s important to understand all possibilities and the tax implications that could come with each scenario.

Pre-IPO / Pre-liquidity event: If you exercise your options 1 year before selling, and your grant date was at least 2 years prior to the date you sell the shares, you’ll only have to pay long term capital gains tax on your profit, rather than the much higher typical ordinary income tax rate. This is called a “Qualifying Disposition”.

If the fair market value (determined by the most recent 409a valuation) of your company’s shares has risen above your strike price, you may also have to pay Alternative Minimum Tax (AMT) at the time you exercise. The federal AMT tax rate is 28% of the difference between the fair market value of your shares and the value of your shares at the strike price. This is called the “bargain element” - known as a “preference item” when calculating Alternative Minimum Tax vs. Regular Federal Tax.

Post-IPO / Post-liquidity event: If you’re at a seed-stage startup, your strike price could be extremely low - something like $0.05/share. In this case, early exercising 1,000 options would only cost you $50. At a Series B stage company, on the other hand, your strike price could be higher - something like $3.00/share. Early exercising 5,000 options at this price would cost you $15,000.

If you don’t have enough cash readily available to exercise your stock options and your company has gone public, you can perform a “cashless exercise”.

In a cashless exercise, your employer or a brokerage firm will give you an implied loan to exercise the options, then sell the stock at market price immediately. This usually happens behind the scenes and doesn’t operate like a traditional consumer loan.

NEXT STEPS

The nuances of startup equity and taxes can be overwhelming. There are many players in the game including your company, outside investors, the board of directors, the IRS, and YOU.

Like all things - having a plan and understanding the facts is the key to success. You might have a colleague in the same role, same salary, same start date, and same age as you - it doesn’t necessarily mean both of you will follow the same playbook to cashing in on your startup success.

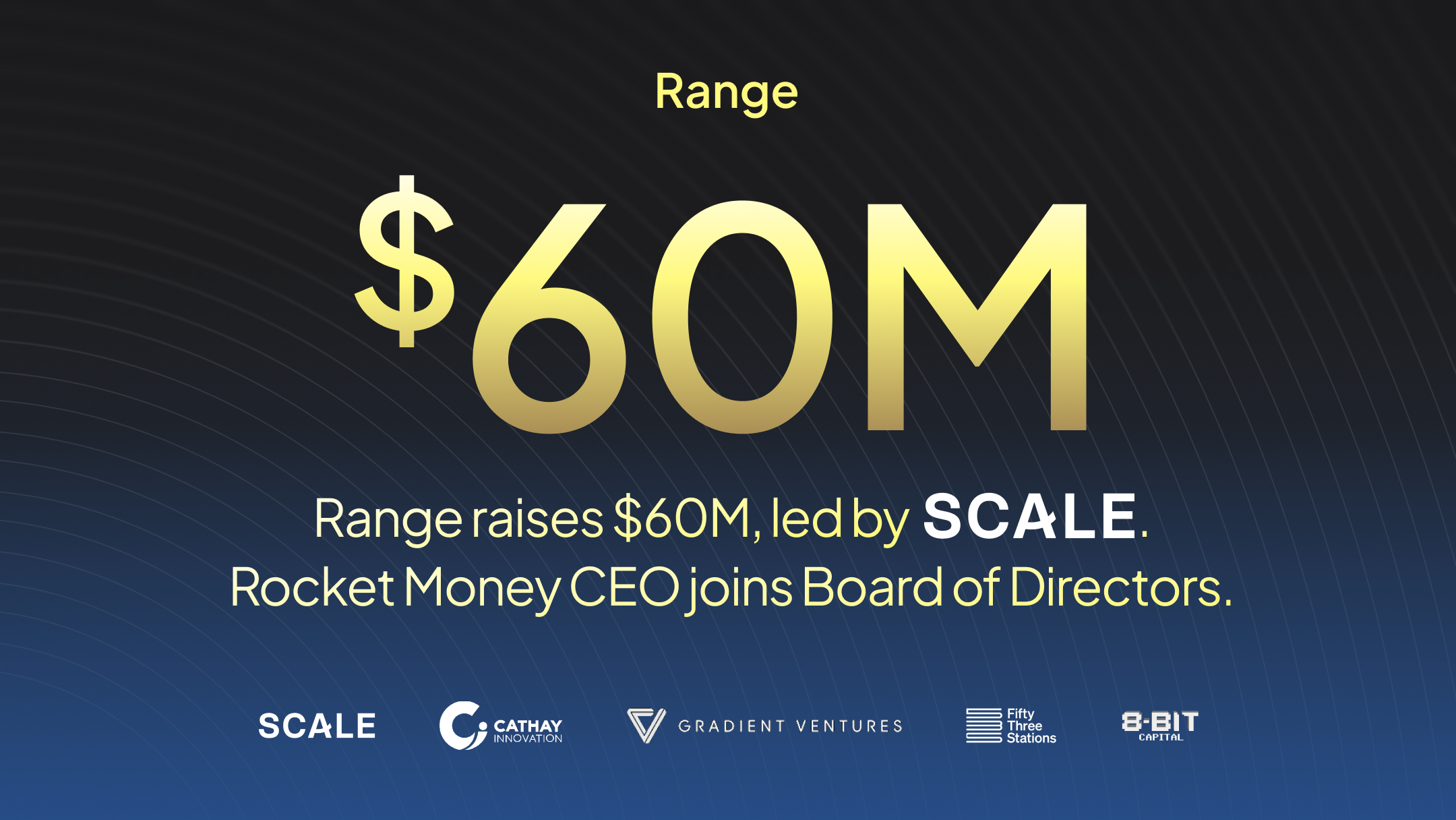

Range is here to help.

With Range, you can connect all your finances into a single dashboard to track, monitor and plan the best version of your life. Say goodbye to middlemen and spreadsheets and hello to the new financial you.

.svg)

.svg)

.svg)