TL;DR

A recession is a period between a peak of economic activity and its subsequent trough, or low point. Many millennials barely remember 2008-2009, likely don't remember 2000-2002, and weren't even alive for 1987’s Black Monday market crash. This recession will likely be different, and not necessarily in a bad way. You have to consider where we’ve been, to know where we’re going! Always have a plan in place regardless of the outcomes in the economy and stock market.

RECESSIONS IN RECENT MEMORY

It’s been a long time since a prolonged recession, and this one might feel different (notice we didn’t say worse!). So, your playbook to prepare for it should be different too. What will you do? Do you have some cash to respond? Do you have a cash flow plan in place? What is your investment strategy?

Don’t panic - there are several things you can do to weather the storm.

First, a quick history lesson...

2001-2002 The “Dot-Com” Bubble

Also known as the dot-com boom, the tech bubble, and the Internet bubble. This was a stock market crash caused by excessive speculation of Internet-related companies in the late 1990s, which was a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up a large portion of the gains experienced by investors. Companies went bankrupt, investors lost trillions, and the economy entered a recession.

2008-2009 The Great Recession

The Great Recession refers to the economic downturn from 2007 to 2009 after the bursting of the U.S. housing bubble and the onset of the global financial crisis. The economic slump began when the U.S. housing market went from boom to bust, and large amounts of mortgage-backed securities and derivatives lost significant value. Unemployment rose, companies faced major layoffs, and homeowners saw their home values decrease significantly or experienced foreclosure.

Spring 2020 COVID-19 flash crash

The COVID-19 stock market crash in February & March of 2020 was a “Black Swan Event” that occurred between February 12, 2020 and March 23, 2020. In just 40 days, the Dow Jones Industrial Average lost 37% of its value. In the stock market, a black swan event is a financial, global health, or geopolitical crisis that is mostly unpredictable. The COVID-19 pandemic saw a widespread and near-immediate impact across the world, but financial markets were able to recover all losses and continue an upward trend in 2021.

Aside from the pandemic-induced 2020 recession, other recent recessions have been credit-driven, including the Great Financial Crisis of 2007-2008 and the dot-com bust of 2000-2001. In those cases, debt-related excesses built up in housing and internet infrastructure, and it took nearly a decade for the economy to absorb them!

By contrast, excess liquidity (aka easy cash) in the current economy is the most likely catalyst for a recession today. In this case, extreme levels of COVID-related stimulus pumped money into households and investment markets in 2020 and 2021, contributing to inflation and driving speculation in financial assets, including cryptocurrency.

RECESSION PLAYBOOK

It’s been a long time since a prolonged recession, and this potential for one feels different (notice we didn’t say worse!). So, your playbook to prepare for it should be different too. Investors should remain patient and consider using tax-efficient rebalancing, including harvesting capital losses to neutralize any potential overexposures and underexposures to certain asset classes or investment holdings.

NEXT STEPS

As always, it’s a great idea to have a playbook in place to be able to acknowledge, evaluate, & plan.

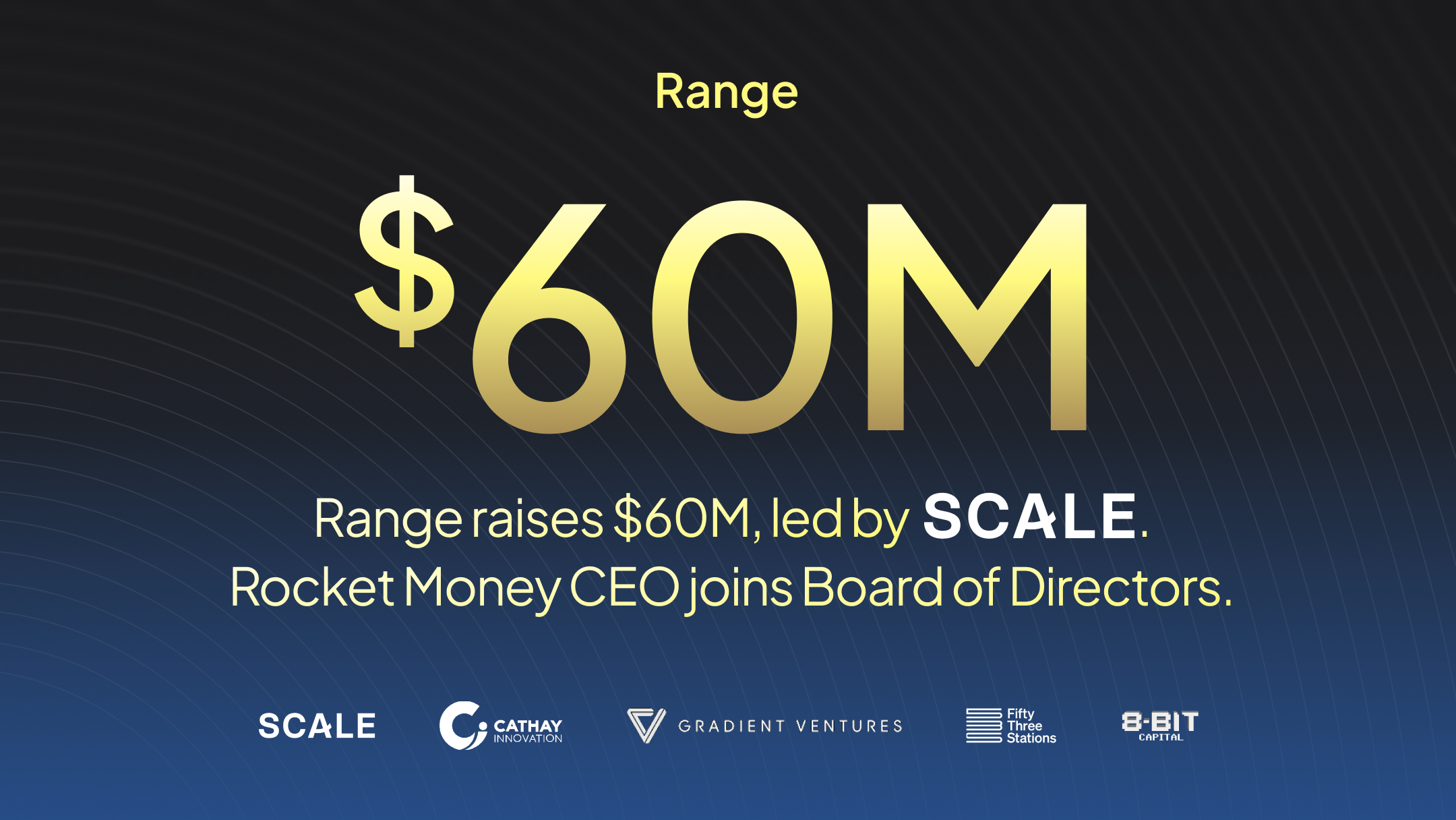

Range is here to help.

With Range, you can connect all your finances into a single dashboard to track, monitor and plan the best version of your life. Say goodbye to middlemen and spreadsheets and hello to the new financial you.

.svg)

.svg)

.svg)