If you've been thinking about taking some time off from work, you're not alone. Sabbaticals have become popular in recent years. The 2018 Employee Benefits Report by the Society for Human Resource Management found that 15 percent of companies surveyed offer sabbaticals to their employees, and only 5 percent of those surveyed offered them as a paid benefit. However, hitting pause on work is still within reach, it just requires smart planning and disciplined saving.

When determining whether you can afford an unpaid sabbatical and how much one will cost, consider these factors:

How much you'll need to save, and how long it will take.

The amount of money you'll need depends on the length of your sabbatical. If you’re planning to take a year off, you’ll want a cash runway of at least one year’s living expenses. Living expenses are consistent expenses such as housing, food, entertainment, investing, and transportation. For example, if you own your home, your runway will need to include your mortgage and property taxes. If travel is involved, you'll need to include any relevant travel expenses..

It can take a year or two to save for a sabbatical, if you want to balance it with other goals such as purchasing a home or starting a business. You can shorten the time by reducing current expenses or modifying your savings strategy for longer-term goals.

Travel is more expensive than you think!

Travel is a big part of the sabbatical experience. In fact, it's one of the main reasons people choose to take time off in the first place. But travel can be more expensive than you think—especially when you consider staying at home and using paid time off may actually cost less.

To plan for your sabbatical, start by researching what kind of trip you want to take. Hike through a national park? Ride an elephant carousel in Thailand? Or cruise around Europe? This will help determine how much money you need for your adventure. You'll also need to consider whether or not your employer offers any assistance with travel costs—many do not but some may cover 50% or more!

Expenses while on sabbatical.

- Housing: You’ll need to make sure you can afford your current mortgage or rent and lodging if you plan to travel. If you plan to travel for an extended period of time you might look into renting or Airbnb out your home to help cover mortgage expenses.

- Food: Make sure to plan your food spend based on what you want to experience. In some countries, eating out is cheaper than buying groceries and cooking at home. In other countries, it can be quite expensive to eat out.

- Entertainment: What do you enjoy doing? Think through activities you want to spend your money on.

- Investing: Do you want to continue saving and contributing to your investment accounts? Or, pause while away?

- Transportation: Do you need to buy a car or rent one? Will public transportation be available where you're going?

You may have to obtain your own health insurance.

Depending on your circumstances you might have to set up your own health insurance for the duration of your sabbatical. Health insurance will likely be the most significant expense, easily taking up to 12 percent of your budget

Before deciding on an option for obtaining short-term coverage, it's important to understand how limited duration plans work.Temporary (or limited duration) plans are short-term plans that do not meet the Affordable Care Act's minimum essential coverage requirements for individual market plans (non-group or non-family). These plans generally last less than three months and may not cover pre-existing conditions. These plans usually have higher premiums and lower benefits than traditional medical insurance. The ACA requires all individuals to have some form of qualifying medical coverage until December 15th to avoid paying tax penalties the following year.

It's common for certain benefits to pause when leaving work for a sabbatical.

You may lose certain benefits when leaving your job for a sabbatical, including:

- Life insurance: If you have employer sponsored life insurance and aren't married, it's unlikely that you'll be able to keep it if you take time off. However, some companies will allow you to keep your coverage by paying the premiums yourself.

- Income: In most cases, your employer will not pay you for any time taken. However, some companies do offer a certain amount of paid sabbatical time as part of their benefits package. If this is the case for you, then all or part of that salary can be paid out during this time.

- Retirement: While on sabbatical, you won’t be able to make contributions to your employer's retirement plan, which includes any employer or voluntary contributions. If you're planning on taking time off from work and returning to the same company (or another one), make sure that any retirement accounts are set up properly before leaving.

Next steps

While there is a lot of preparation necessary when thinking about taking a sabbatical, don't let it overwhelm you. Instead, create a plan that carefully considers your budget and make sure you’re saving enough money to cover the costs.

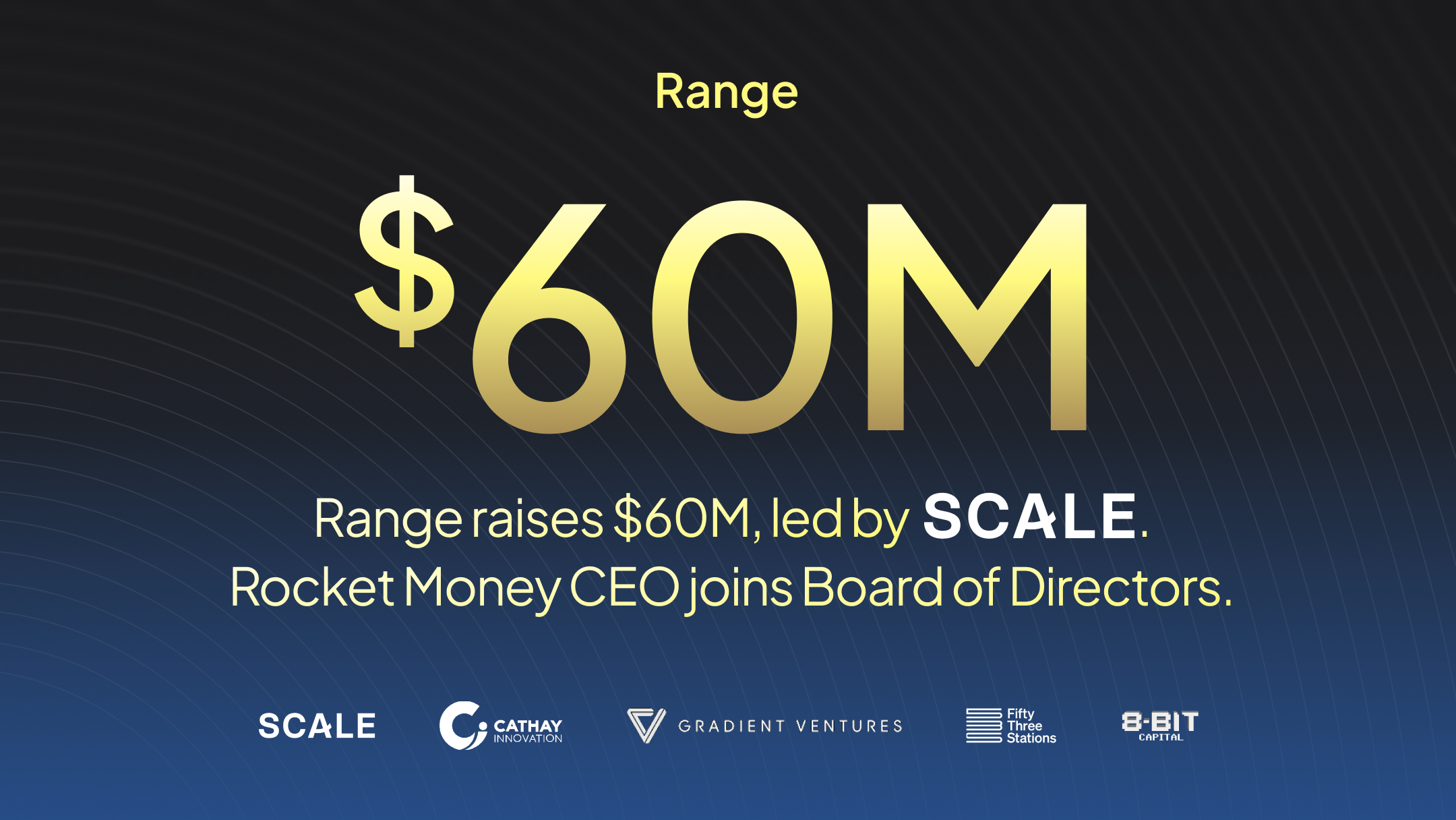

Range is here to help.

With Range, you can set goals, like taking a sabbatical, and work with our team of Certified Financial Planners to come up with a timeline and budget to help your dream become reality.

.svg)

.svg)

.svg)